what basket of currency can averagte american use to be safe

October 06, 2021

The International Function of the U.S. Dollar

Carol Bertaut, Bastian von Beschwitz, Stephanie Curcurui

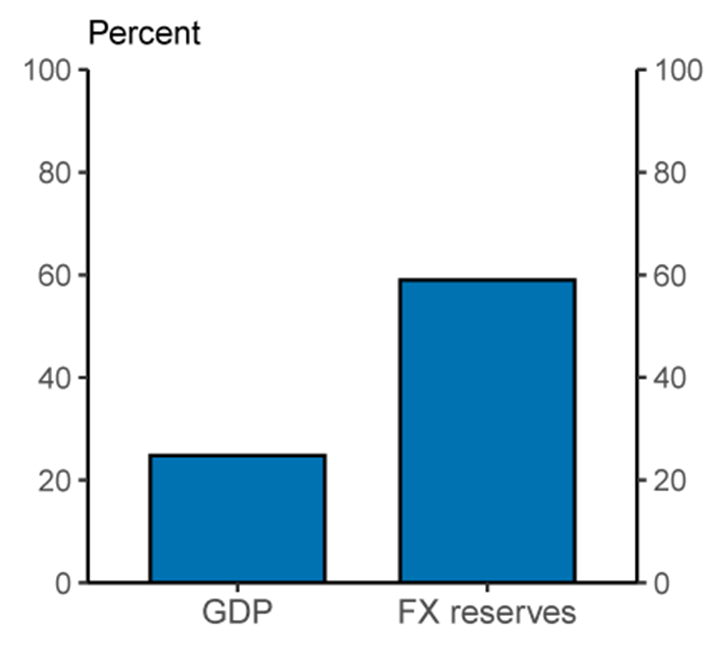

For most of the last century, the preeminent role of the U.S. dollar in the global economy has been supported past the size and strength of the U.S. economic system, its stability and openness to merchandise and majuscule flows, and strong belongings rights and the rule of law. As a consequence, the depth and liquidity of U.S. fiscal markets is unmatched, and at that place is a large supply of extremely safety dollar-denominated assets. This note reviews the utilise of the dollar in international reserves, as a currency ballast, and in transactions.two By most measures the dollar is the dominant currency and plays an outsized international role relative to the U.Due south. share of global GDP (see Effigy i). That said, this dominance should not be taken for granted and the annotation ends with a word of possible challenges to the dollar'due south status.

Effigy 1. U.S. share of world GDP vs. U.S. dollar share of international reserves

At that place is widespread confidence in the U.Southward. dollar as a store of value

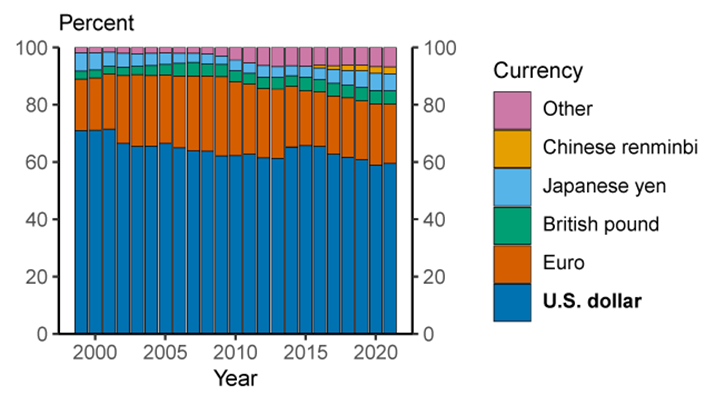

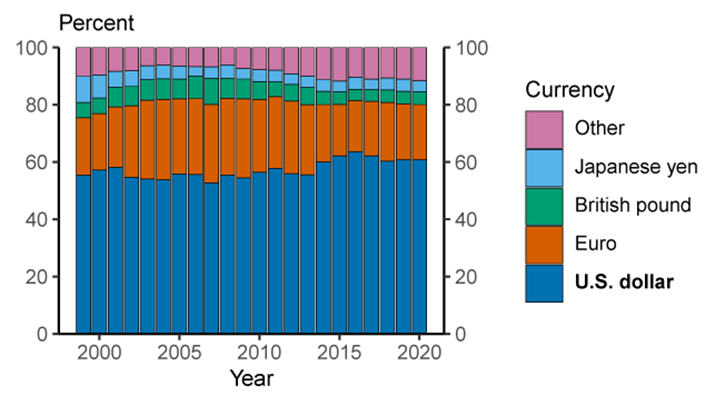

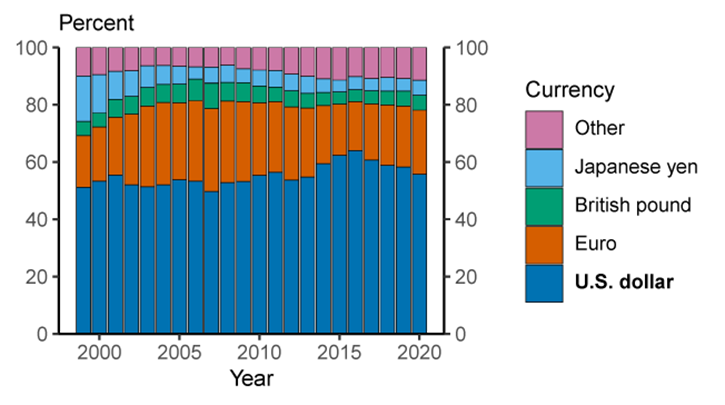

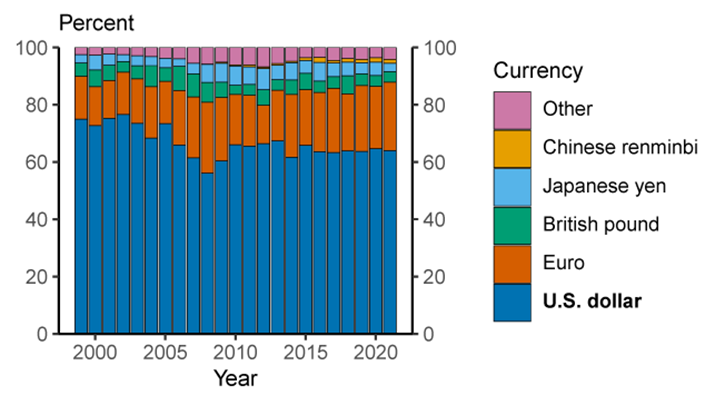

A central role of a currency is as a store of value which can be saved and retrieved in the future without a significant loss of purchasing power. One measure of confidence in a currency every bit a store of value is its usage in official foreign commutation reserves. As shown in Effigy ii, the dollar comprised 60 percentage of globally disclosed official foreign reserves in 2021. This share has declined from 71 per centum of reserves in 2000, but nevertheless far surpassed all other currencies including the euro (21 percent), Japanese yen (6 percent), British pound (v per centum), and the Chinese renminbi (2 percent). Moreover, the decline in the U.Due south. dollar share has been taken up by a wide range of other currencies, rather than by a single other currency. Thus, while countries accept diversified their reserve holdings somewhat over the past ii decades, the dollar remains past far the ascendant reserve currency.

Figure 2. Foreign commutation reserves

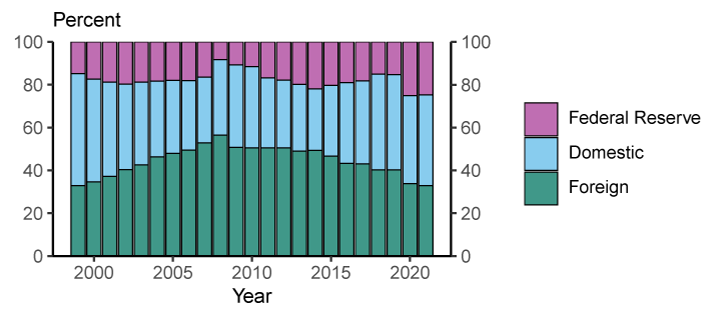

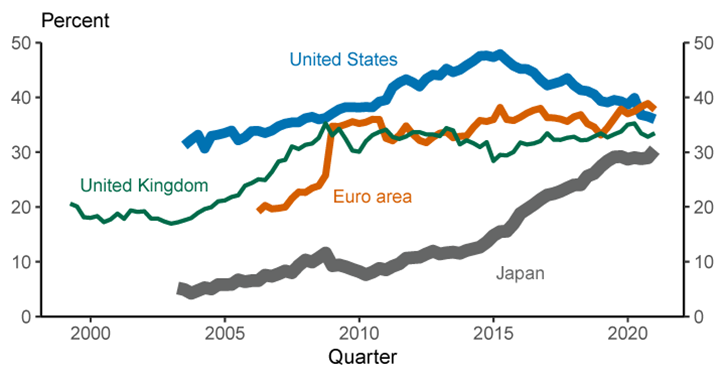

The bulk of these official dollar reserves are held in the course of U.S. Treasury securities, which are in high demand by both official and private foreign investors. As of the end of the first quarter of 2021, $vii.0 trillion or 33 percent of marketable Treasury securities outstanding were held by foreign investors, both official and private (see Figure 3a), while 42 percent were held by private domestic investors, and 25 percent by the Federal Reserve System. Although the share of Treasuries held by foreign investors has declined from almost 50 per centum in 2015, the electric current foreign share of Treasury holdings is comparable to the share of euro-area authorities debt held by investors outside of the euro area (shown in Figure 3b) and higher than the foreign-held shares of British or Japanese government debt.

Figure 3. Foreign holdings of government debt

3a. Holdings of marketable U.S. Treasuries

3b. Share of general government debt securities held past foreign investors

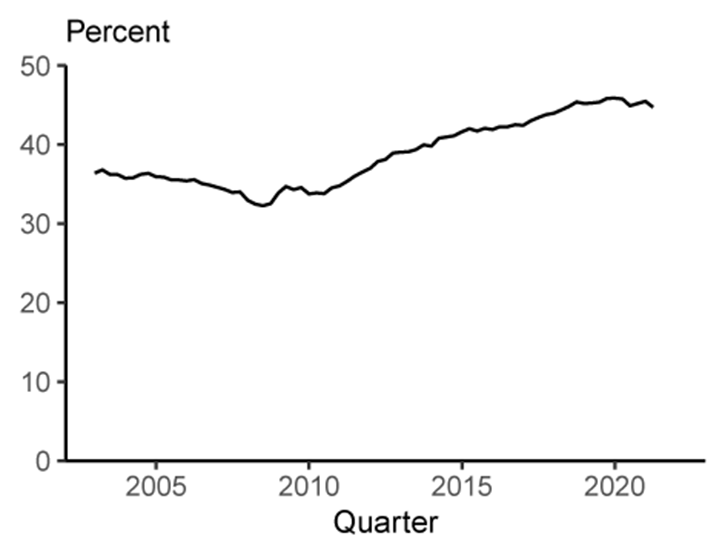

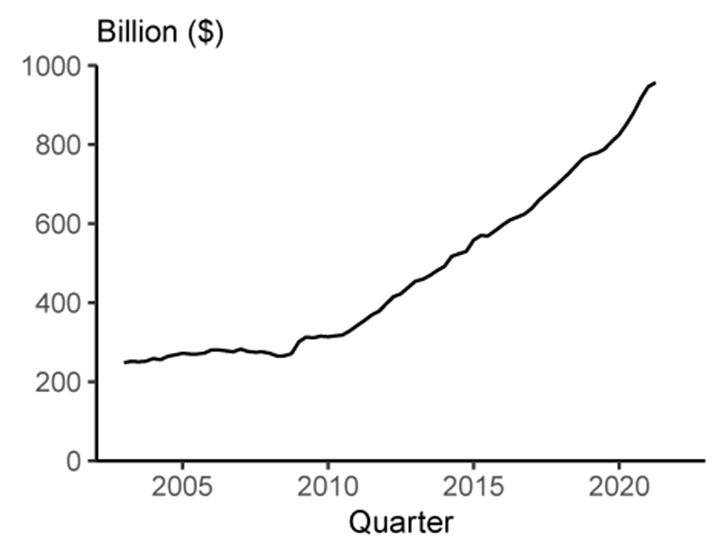

Foreign investors besides concur substantial amounts of paper banknotes. As shown in Figure 4, the value of U.S. dollar banknotes held abroad has increased over the by ii decades, both on an accented basis and as a fraction of banknotes outstanding. Federal Reserve Lath staff guess that over $950 billion in U.Due south. dollar banknotes were held by foreigners at the end of the get-go quarter of 2021, roughly one-half of total U.S. dollar banknotes outstanding.

Figure 4. Foreign holdings of U.S. dollar banknotes

4a. Share of U.S. dollar banknotes

4b. Amount of U.S. dollar banknotes

Additionally, many foreign countries leverage the effectiveness of the U.South. dollar as a store of value by limiting the movements of their currencies with respect to the U.Southward. dollar – in other words, using information technology as an anchor currency. As Ilzetzki, Reinhart, and Rogoff (2020) highlight, the dollar's usage as an ballast currency has increased over the by two decades. They estimate that l percentage of world GDP in 2015 was produced in countries whose currency is anchored to the U.S. dollar (not counting the The states itself).three In contrast, the share of earth GDP anchored to the euro was only 5 pct (non counting the euro area itself). Moreover, since the end of the Ilzetzki et al. sample in 2015, this anchoring has changed little. One exception might be the re-anchoring of the the Chinese renminbi from the U.S. dollar to a basket of currencies. Still, the U.Due south. dollar and currencies anchored to the U.S. dollar comprise over l percent of this basket. So in practice, the Chinese renminbi remained finer anchored to the U.S. dollar according to the Ilzetzki et al. definition, because in 90 percent of months betwixt January 2016 and April 2021 the renminbi moved less than 2 percent against the U.South. dollar.4

The U.S. dollar is dominant in international transactions and financial markets

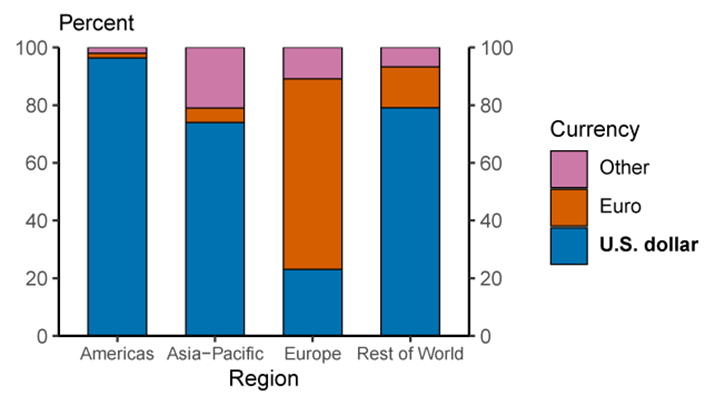

The international role of a currency tin too be measured by its usage as a medium of exchange. The dominance of the dollar internationally has been highlighted in several recent studies of the currency limerick of global trade and international fiscal transactions. The U.South. dollar is overwhelmingly the world's most frequently used currency in global trade. An estimate of the U.S. dollar share of global trade invoices is shown in Figure v. Over the flow 1999-2019, the dollar accounted for 96 percent of trade invoicing in the Americas, 74 percent in the Asia-Pacific region, and 79 per centum in the rest of the world. The only exception is Europe, where the euro is ascendant.

Effigy 5. Share of export invoicing

In function because of its dominant role as a medium of substitution, the U.S. dollar is also the dominant currency in international cyberbanking. As shown in Figure 6, about sixty percent of international and foreign currency liabilities (primarily deposits) and claims (primarily loans) are denominated in U.S. dollars. This share has remained relatively stable since 2000 and is well higher up that for the euro (about xx percent).

Figure six. Share of international and strange currency banking claims and liabilities

6a. Claims

6b. Liabilities

With dollar financing in particularly high demand during times of crisis, foreign financial institutions may face difficulties in obtaining dollar funding. In response, the Federal Reserve has introduced two programs to ease crisis-induced strains in international dollar funding markets, thus mitigating the effects of strains on the supply of credit to domestic and strange firms and households. To ensure that dollar financing remained bachelor during the 2008-2009 financial crisis, the Federal Reserve introduced temporary swap lines with several foreign primal banks, a subset of which were made permanent in 2013.5 During the COVID-nineteen crunch in March 2020, the Federal Reserve increased the frequency of operations for the standing swap lines and introduced temporary bandy lines with additional counterparties.half dozen The Federal Reserve as well introduced a repo facility available to Foreign and International Monetary Regime (FIMA) with accounts at the Federal Reserve Banking company of New York, which was fabricated permanent in 2021.7 Both the bandy lines and FIMA repo facility have enhanced the continuing of the dollar as the ascendant global currency, as approved users know that in a crisis they have access to a stable source of dollar funding. The swap lines were extensively used during the 2008-2009 fiscal crisis and the 2020 COVID-xix crisis, reaching outstanding totals of $585 billion and $450 billion, respectively (run into Figure 7a). Although other key banks have also established swap lines, not-dollar-denomindated swap lines offered past the European Central Bank and other cardinal banks saw lilliputian usage (run across Figure 7b). This fact highlights how crucial dollar funding is in the operations of many internationally agile banks.

Effigy vii. Central bank swap lines

Issuance of foreign currency debt—debt issued by firms in a currency other than that of their dwelling house land — is also dominated by the U.S. dollar. The percentage of foreign currency debt denominated in U.S. dollars has remained around 60 percentage since 2010, as seen in Figure eight. This puts the dollar well alee of the euro, whose share is 23 per centum.

Effigy eight. Share of foreign currency debt issuance

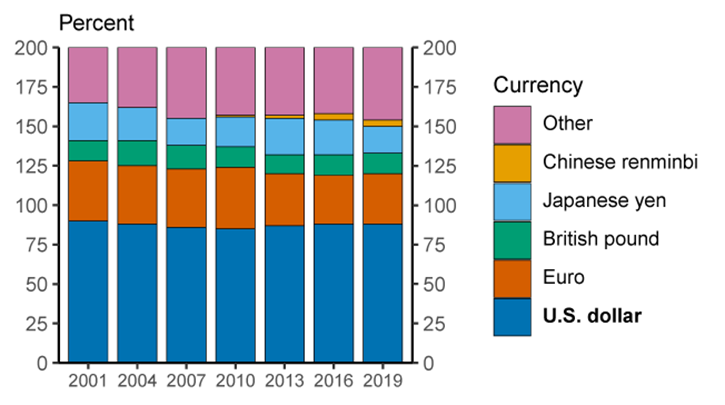

The many sources of demand for U.S. dollars are likewise reflected in the high U.Southward. dollar share of foreign exchange (FX) transactions. The nearly recent Triennial Fundamental Bank Survey for 2019 from the Banking company for International Settlements indicated that the U.S. dollar was bought or sold in about 88 percent of global FX transactions in April 2019. This share has remained stable over the past twenty years (Effigy 9). In contrast, the euro was bought or sold in 32 percent of FX transactions, a refuse from its peak of 39 percent in 2010.8

Effigy ix. Share of over-the-counter foreign exchange transactions

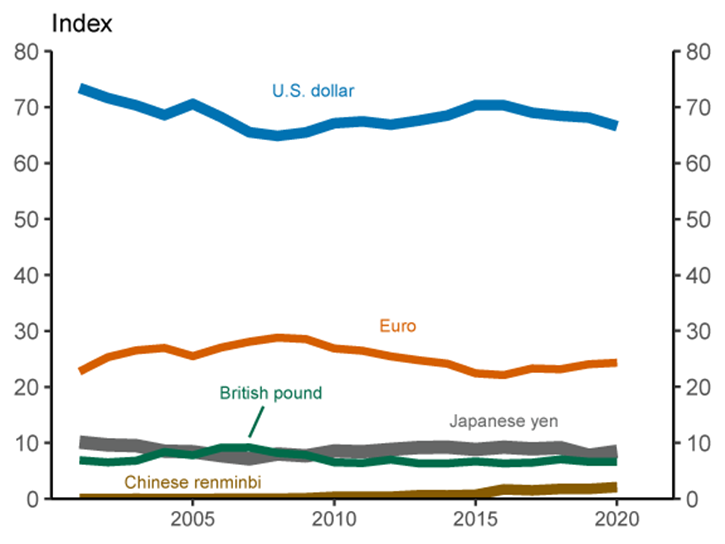

Overall, U.Southward. dollar dominance has remained stable over the past 20 years

A review of the use of the dollar globally over the last two decades suggests a dominant and relatively stable role. To illustrate this stability, we construct an aggregate index of international currency usage. This index is computed every bit the weighted average of five measures of currency usage for which time serial data are available: Official currency reserves, FX transaction volume, strange currency debt instruments outstanding, cross-border deposits, and cross-border loans. We display this index of international currency usage in Figure 10. The dollar index level has remained stable at a value of about 75 since the Global Financial Crisis in 2008, well ahead of all other currencies. The euro has the adjacent-highest value at virtually 25, and its value has remained fairly stable as well. While international usage of the Chinese renminbi has increased over the by twenty years, information technology has only reached an index level of about 3, remaining fifty-fifty backside the Japanese yen and British pound, which are at about 8 and seven, respectively.

Figure ten. Index of international currency usage

Diminution of the U.S. dollar's status seems unlikely in the near term

Nearly-term challenges to the U.Southward. dollar's dominance appear express. In modern history at that place has been only ane case of a predominant currency switching—the replacement of the British pound past the dollar. The dollar rose to prominence after the financial crisis associated with World War I, then solidified its international part subsequently the Bretton Forest Agreement in 1944 (Tooze 2021, Eichengreen and Flandreau 2008, Carter 2020).9

All the same, over a longer horizon there is more than risk of a challenge to the dollar'due south international status, and some recent developments have the potential to boost the international usage of other currencies.

Increased European integration is ane possible source of challenge, as the European Matrimony (European union) is a large economy with fairly deep financial markets, generally free trade, and robust and stable institions. During the COVID-19 crunch, the Eu fabricated plans to effect an unprecedented corporeality of jointly backed debt. If financial integration progresses and a large, liquid market place for Eu bonds develops, the euro could go more than attractive as a reserve currency. This integration could potentially be accelerated by enhancements to the European union's sovereign debt marketplace infrastructure and introducing a digital euro. Additionally, the euro's prominent role in corporate and sovereign dark-green finance could bolster its international status if these continue to grow. However, even with more than fiscal integration, remaining political separation will continue to cause policy doubt.

Another source of challenges to the U.S. dollar's potency could be the connected rapid growth of China. Chinese Gdp already exceeds U.S. GDP on a purchasing power parity ground (IMF World Economical Outlook, July 2021) and is projected to exceed U.S. Gdp in nominal terms in the 2030s.10 Information technology is likewise past far the world's largest exporter, though it lags the United states past value of imports (IMF Direction of Trade Statistics, 2021-Q2). In that location are pregnant roadblocks to more widespread apply of the Chinese renminbi. Importantly, the renminbi is not freely exchangeable, the Chinese capital business relationship is not open, and investor confidence in Chinese institutions, including the rule of law, is relatively depression (Wincuinas 2019). These factors all make the Chinese renmimbi—in whatever form—relatively unattractive for international investors.

A shifting payments mural could too pose a challenge to the U.S. dollar'southward dominance. For instance, the rapid growth of digital currencies, both private sector and official, could reduce reliance on the U.S. dollar. Changing consumer and investor preferences, combined with the possibility of new products, could shift the balance of perceived costs and benefits enough at the margin to overcome some of the inertia that helps to maintain the dollar's leading office. That said, it is unlikely that technology alone could modify the landscape plenty to completely start the long-standing reasons the dollar has been dominant.

In sum, absent-minded any large-scale political or economical changes which damage the value of the U.S. dollar equally a store of value or medium of exchange and simultaneously eternalize the attractiveness of dollar alternatives, the dollar will probable remain the world's dominant international currency for the foreseeable future.

References

Banking company for International Settlements. BIS Data Banking concern.

Boz, Due east., C. Casas, One thousand. Georgiadis, Thousand. Gopinath, H. Le Mezo, A. Mehl, and T. Nguyen (2020). "Patterns in Invoicing Currency in Global Merchandise." IMF Working Paper No. 20-126.

Carter, Z. (2020). The Toll of Peace: Money, Democracy, and the Life of John Maynard Keynes. Random House.

Committee on the Global Financial System (CGFS), (2020). "U.South. dollar funding: an international perspective." BIS CGFS Papers No 65.

Dealogic, DCM Director, http://www.dealogic.com/en/fixedincome.htm.

The Economist (2020). "Dollar authorization is equally secure as American leadership." https://www.economist.com/finance-and-economic science/2020/08/06/dollar-say-so-is-as-secure-as-american-global-leadership. Accessed August 18, 2021.

Eichengreen, B. and M. Flandreau (2008). "The Ascension and Autumn of the Dollar, or When Did the Dollar Replace Sterling as the Leading International Currency?" NBER Working Papers No. 14154.

Judson, R. (2017). "The Decease of Cash? Not So Fast: Demand for U.S. Currency at Home and Away, 1990-2016." International Cash Conference 2017.

Refinitiv, Thomson ONE Investment Banking with Deals module and SDC Platinum, http://world wide web.thomsonone.com/.

Tooze, A. (2021). "The Ascent and Fall and Rise (and Fall) of the U.S. Financial Empire." Foreign Policy https://foreignpolicy.com/2021/01/15/rising-fall-united-states-financial-empire-dollar-global-currency Accessed Baronial thirteen, 2021.

Wincuinas, J. (2019). "The Communist china position: Gauging institutional investor confidence." Economist Intelligence Unit. https://eiuperspectives.economist.com/financial-services/china-position-gauging-institutional-investor-confidence Accessed August 18, 2021.

Delight cite this annotation as:

Bertaut, Carol C., Bastian von Beschwitz, and Stephanie Due east. Curcuru (2021). "The International Office of the U.S. Dollar," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 06, 2021, https://doi.org/ten.17016/2380-7172.2998.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.

Source: https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-20211006.htm